Jude Ayua, Associate and Senator Ihenyen, Lead Partner

PDF version available here for download

Introduction

The eNaira, Nigeria’s central bank digital currency (CBDC), was launched 25 October 2021. The digital version of the Naira, eNaira is equally a legal tender. Therefore, it serves as a medium of exchange and a store of value. The eNaira leverages the power of blockchain technology, the same technology cryptocurrencies such as bitcoin, Ether, Litecoin, etc. are built on. But a CBDC, including the eNaira, is centralized. Although similar to cryptocurrencies, the value of a CBDC is fixed by the central bank and equivalent to a country’s fiat currency.1 Its main goal, among others, is “to provide businesses and consumers with privacy, transferability, convenience, and financial security.”2 Issued by the Central Bank of Nigeria (CBN), the eNaira is a liability of the CBN. Launched by former President Muhammadu Buhari, the eNaira is the “same Naira, more possibilities”.3

In March 2023, eNaira transaction value increased by 63% to 22 billion naira ($47.7 million). Nigerians have so far opened around 13,000,000 (thirteen million) e-wallets on the eNaira platform. This is according to a Bloomberg report credited to the now-suspended Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele.4 The figure represents more than a 1200% boost from January to May 2023. This spike is reportedly attributed to the recent redesign of the Naira notes by the CBN which occasioned the shortage of mint in circulation. According to Mr. Emefiele, the amount of mint in circulation declined from 3.2 trillion Naira to 1 trillion Naira in the same period.5

In this article, we consider how well the eNaira has fared, considering its adoption rate and related factors. Towards bridging the gaps we identify, we will briefly discuss four (4) major considerations that can boost eNaira adoption.

How has the eNaira really fared so far?

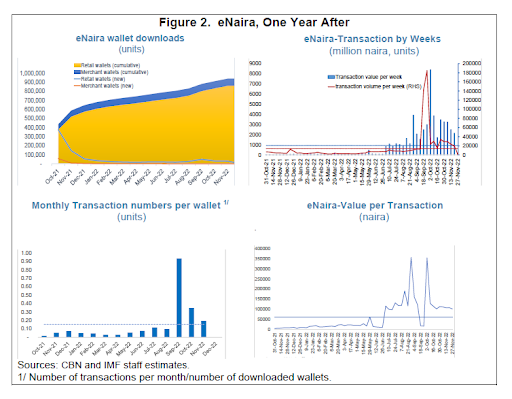

The eNaira Speed Wallet application became available for download on Google Play Store and App store on 28 October 2021. Within the first 25 days of launching the eNaira in October 2021, the eNaira app had up to 500,000 eNaira downloads. It took the eNaira a full year—precisely till November 2022—to reach 860,000.

Since inception, eNaira transactions on the average, amounts to about 14,000 weekly. This represents only 1.5% of existing eNaira wallets. In other words, 98.5% of eNaira wallets are not in use.

Meanwhile, according to DataReportal, Nigeria had 122.5 million internet users at the start of 2023 and a total of 193.9 million cellular mobile connections were active in Nigeria in early 2023, with this figure equivalent to 87.7 percent of the total population6

Also, Nigeria’s active bank accounts increased to 133.5 million in December 2021 after adding 18.7 million new active bank accounts, data from Nigeria Inter-Bank Settlement System Plc (NIBSS) shows7

Presently, both merchants and retail customers are not adopting the eNaira as expected, to say the least. eNaira adoption is only about 1% of active bank accounts in Nigeria. The figure below from ‘Nigeria’s eNaira, One Year After’, a report published in the IMF Working Papers:8

Also, despite the recently reported spikes in eNaira transactions, eNaira’s usage rate remains low presently. At the time of writing, the eNaira recorded $48 million worth of transactions. This is against the over $14 billion worth of transactions completed in 2022 via digital payments in the country.

However, the current level of eNaira adoption rate in Nigeria is also understandable since a phased approach was adopted by the CBN upon launch. The CBN made eNaira wallet available to only bank account owners, as well as for local transactions only. As CBN moves to the next phase, it must take steps that encourage collaboration and also boost public trust and confidence in both the monetary system and the regulatory regime.

CBN’s strategy of eNaira adoption through government’s welfare programs and Naira redesign

First, according to the CBN, eNaira will “enable effective, equitable, and faster distribution of cash assistance to households and communities included in government social welfare programs”.9 Indeed, enabling funds distribution under the various social intervention programs of the Federal Government is listed in the Design Paper for the eNaira as one of the major use cases of the eNaira.10 y distributing financial aid to the targeted beneficiaries through eNaira wallets, four (4) million new eNaira wallets were reportedly created.

But a major challenge to eNaira adoption here may be illiteracy (including digital illiteracy) which is more common with Nigerians living in abject poverty, the typical target of most social welfare programs of the Federal Government. Without addressing this, most of the eNaira wallets created will end up unused or underused. Besides, there is also the increased risk of unenlightened and unsuspecting users experiencing fraud.

Second, the CBN Naira redesign policy, which among other purposes, was supposed to address the hoarding of cash, did not make much positive impact. Quite the opposite, the Naira redesign ended up causing untold hardship to the majority of Nigerians.11

Interestingly, the CBN aligned the purpose of the Naira redesign policy to that of the launching of the eNaira. One of the reasons for the redesign, Mr. Emefiele noted in the October-22 Press Remarks, was to limit the amount of cash in circulation, and encourage the adoption of the digital currency, eNaira. According to the CBN Governor, “… as at the end of September 2022, available data at the CBN indicate that N2.73 Trillion out of the N3.23 Trillion currency in circulation, was outside the vaults of Commercial Banks… currency in circulation has more than doubled since 2015; rising from N1.46 Trillion in December 2015 to N3.23 Trillion in September 2022”. This, the CBN would not allow to continue, he pointed out. Besides, “[w]e believe that the redesign of the currency will help deepen [CBN’s] drive to entrench [a] cashless economy as it will be complemented by increased minting of our eNaira,” Mr Emefiele added. Limiting the cash in circulation in order to boost eNaira adoption does not appear to have been well-considered. Without genuine need for the eNaira, any artificial measures will hardly work, and may not be sustainable.

Notably, transactions in Nigeria are still more dependent on cash payments than digital payments. Up to 90% of transactions in the informal economy are completed with cash. The attempt to push the adoption of the eNaira by redesigning the Naira is yet unsuccessful.

Though the CBN Governor at the time maintained that “[t]he eNaira has emerged as the electronic payment channel of choice for financial inclusion and executing social interventions,” the numbers clearly do not appear to agree.

How can Nigeria fix the numbers?

Major considerations that can close the gaps and boost eNaira adoption

We highlight below four (4) major areas that we believe the CBN needs to address concerning eNaira adoption, if it is not already doing so:

1. Integrating mobile money operators (MMOs) with the eNaira

The CBN needs to get the buy-in of mobile money operators (MMOs). Currently, MMOs in Nigeria are not being keyed into the eNaira project. In fact, in the four-phased launch of the eNaira, MMOs are not captured. Keying mobile money operators—as with other relevant players and stakeholders in and outside the payment space—is vital. The International Monetary Fund, in its review of the eNaira, published May 2023 in the IMF Working Paper, Nigeria’s eNaira, One Year After, also identified this need recently.12

Noting that “[d]espite the laudable undisrupted operation for the first full year, the CBDC project has not yet moved beyond the initial wave of limited adoption”, the IMF pointed out that “[n]etwork effects suggest the initial low adoption spell will require a coordinated policy drive to break it.” Among other things, the IMF recommended that “[t]he eNaira’s potential in financial inclusion requires a strategy to set the right relationship with mobile money, given the former’s potential to either complement or substitute the latter.”13

With the use of Application Programming Interface (API)—which by the way should be readily available on eNaira website—MMOs should be able to have their apps communicate seamlessly with the eNaira platform.

2. Plugging eNaira to diaspora remittances through International Money Transfer Operators (IMTOs)

Diaspora remittances is a key source of foreign exchange in Nigeria and across sub-saharan Africa. Up to US$23.8 Billion was remitted in 2019 from diaspora. According to the eNaira implementation roadmap as captured in the Design Paper for the eNaira, onboarding IMTOs for remittances is planned for phase 2 of the eNaira project.

With phase 2 of the eNaira project, which includes onboarding the unbanked via USSD and onboarding merchants, ongoing, the CBN eventually issued an operational framework for plugging eNaira to diaspora remittances.14 According to the guidelines provided by the CBN to facilitate diaspora remittances with eNaira as an option, IMTOs are required to either open a merchant wallet with the CBN or integrate their platforms with the eNaira using API. In both cases, IMTOs are to apply for CBN’s approval—a one-time ‘No Objection’ to pay out eNaira.

On the IMTO’s part, it is required to open an eNaira Merchant Wallet and then prefund its account with the CBN with foreign currency. It is from this prefunded account that the CBN will subsequently fund the IMTO Merchant Wallet with eNaira equivalent of the foreign currency. When an overseas sender deposits funds in foreign currency and selects the eNaira remittance option on the IMTO’s portal, the IMTO will log into its web-based eNaira Merchant Wallet, debit it, and credit the beneficiary with the eNaira equivalent of the foreign currency received from the sender overseas using the I&E window rate.

On the senders’ part, on the other hand, they are expected to use any IMTO of their choice overseas. Next, the sender will deposit the intended funds in foreign currency using the I&E window rate. Having received the details of the beneficiary’s eNaira wallet and the funds in foreign currency, the IMTO will credit the beneficiary’s eNaira wallet with the equivalent of foreign currency using the I&E window rate.

It definitely makes commercial sense for the CBN to make eNaira a payment option, thus ensuring that other payment options run concurrently. Essentially, it is really all about the customer’s choice. For instance, eNaira adoption for remittances may not be very attractive to recipients who would wish to receive foreign currency in their domiciliary accounts, not in eNaira. Thankfully, with the FOREX reform presently being carried out by the CBN in Nigeria is gradually restoring confidence. The adoption of the I&E window rate as the applicable rate for currency conversions may have greatly avoided what could have become a serious currency-conversion challenge in the remittance corridor; and consequently, a major disincentive to eNaira as a payment option for remittances.

Under the Emefiele-led CBN, considerable supervisory efforts were made on FOREX restrictions—itself a double-edged sword particularly from a diaspora remittance perspective, at least with hindsight. This may also have negatively impacted diasporan inflows especially through formal channels. And this is where the eNaira comes in. The eNaira could play a better role, adding a window for Nigerians in the diaspora to send money home. Also, this will reduce remittance costs, improve transaction speed, and gradually disincentivize the use of informal channels for remittances. As pointed out by the IMF in the IMF Working Paper referred to earlier, “[c]ost savings from integrating CBDC—as a bridge vehicle—in the remittance process may also be substantial”.15

Therefore, the CBN and IMTOs must ensure safety and security of their platforms, whether the eNaira remittance option is facilitated through merchant wallets or API. This is where the nature and level of AML/CFT compliance, transaction limits balance, and other related measures also come in. Noticeably, the operational framework is silent about this aspect. Also, beyond releasing the operational framework to IMTOs and the general members of the public, the CBN should begin to engage IMTOs, get feedback, and continue to improve the operation of eNaira as a payment option in diaspora remittance to Nigeria.

3. Improving cross-border payments with eNaira through international payment processors and digital payment platforms

Paying for goods and services cross-border has been costly and slow, and for too long. This inefficiency has been in the cross-border payment space for so long that an end user may be forgiven for thinking this a sabotage. While technology and regulation were the major reasons for this in the past, regulation now appears to be the major hurdle. Policymakers and regulators must fix this, especially in the era of new and emerging technologies, including blockchain. The eNaira—like most CBDCs—is powered by blockchain technology. This is the same technology that powers cryptocurrencies, including bitcoin, Ether, and Litecoin.

The eNaira can help streamline the cross-border payment process, making it efficient. As stated by the CBN, eNaira can “significantly reduce the time taken for transactions to be confirmed as it allows real-time cross-border foreign exchange payment-versus-payment transactions for traded goods and services”. Also, the CBN is looking to adopt the eNaira as a separate window for the clearing and settlement of trade, thus providing an alternative to SWIFT international financial messaging and payment systems.

But to get the eNaira to become a reliable and trusted solution to cross-border payments, international cooperation is key. First, eNaira must be designed and pursued considering all countries’ payment systems. Second, eNaira interoperability with global payment systems is vital, requiring basic design, legal, regulatory, and technological standards, otherwise no country would care. Third, the eNaira implementation framework must be structured in a way that benefits from the experience and perspective of all relevant actors in the cross-border payment space. This includes the finance ministry, consumer protection agency, data protection authorities, international organizations, regulators, and key players in the private sector. Without these levels of cooperation, eNaira—or any CBDC for that matter—will struggle with adoption. In fact, without cooperation, the eNaira may be of no meaningful use for cross-border payments.

4. The eNaira as an indigenous, public alternative to foreign-currency-backed, privately-issued stablecoins

The cryptocurrency applications of blockchain technology are gradually impacting the global financial system. These cryptocurrency applications may be in the form of decentralized cryptocurrencies such as bitcoin, Ether, Litecoin for example or stabilized version of cryptocurrencies typically backed by fiat currencies known as stablecoins such as Tether USD (USDT), USD Coin (USDC), Euro Coin (EUROC) for example. The adoption of both decentralized cryptocurrencies and stablecoins continue to grow.

Though currently a fraction of the traditional financial system, the market capitalization of cryptocurrencies and digital assets hit 2.9 trillion dollars in November 2021. Due to market volatility, it is currently just over 1 trillion dollars. In Nigeria, cryptocurrency adoption rate has significantly grown, particularly after the CBN cryptocurrency directive of 5 February 2021 restricting the facilitation of crypto-related transactions in Nigeria’s banking and financial system. No doubt, the CBN restriction may have pushed Nigeria from No. 5 to No. 11 globally, according to the 2022 Global Crypto Adoption Index report released by Chainalysis. But it may also have resulted in pushing more Nigerians to peer-to-peer (p2p) platforms as their major gateway to the crypto world. Paxful, a global decentralized cryptocurrency platform, is one of the p2p crypto platforms that particularly gained from this shift, recording significantly higher transaction volumes in the Nigerian market16

By 2022, Nigeria had become No. 1 globally in p2p crypto adoption. Stablecoins ensured easy liquidity and fast settlement in the market. Clearly, cryptocurrency adoption has continued to grow in Nigeria, but outside regulatory oversight. Though this growth in adoption offers various economic opportunities, there are also risks and threats associated with this. Narrowing down to stablecoins, as the IMF rightly pointed out in its paper, “domestic adoption of global stable coins could cause currency substitution and increase capital flow volatility”. Also, without effective regulation, bad actors will increasingly use decentralized cryptocurrencies and stablecoins to perpetuate fraud, investment scams, money laundering, terrorism financing, and other illicit transactions in the country.17

As a regulator, the CBN will need to consider the role it needs to play as private-sector innovations, including decentralized cryptocurrencies and privately-issued stablecoins, hit the financial system. The role the CBN, and indeed other regulators and the government, decides to play will significantly determine the moves other actors make. In our opinion, the CBN, other regulators, and the government should adopt a stance that enables them to balance the countervailing factors in the space. While introducing prohibitions or extensive regulations could help Nigeria keep decentralized cryptocurrencies and stablecoins away from the banking and financial system as much as possible, adopting a risk-based approach that is measured may help to achieve a safer environment for innovation and regulation to work symbiotically. Due to its unique architecture and design, CBDCs cannot completely serve as central banks’ shield against cryptocurrencies, if that was the original idea. Similarly, CBDCs cannot also ably serve as swords—if conceived so—for central banks’ fight against cryptocurrencies. No. Inherently, cryptocurrencies thrive in resistance. Therefore, fighting cryptocurrencies will most likely only rejuvenate and eventually weaponize them. Consequently, a regulator’s safer approach should be to classify and regulate them accordingly.

As CBDCs, decentralized cryptocurrencies, and stablecoins co-evolve today, there will be increasing need for a framework that is flexible yet robust enough to ensure a safer co-existence. It should not—and cannot—be about one taking the others out. Today’s regulators must reimagine the role of regulation. For instance, given the growing adoption of USDC, USDT, and other foreign-currency backed stablecoins in Nigeria, the CBN can introduce a Naira-backed stablecoin as a reliable alternative. With the right technological architecture and design, eNaira can serve this much-needed purpose, boosting eNaira adoption. In other words, beyond a digital currency, eNaira can serve as an infrastructure facilitating and integrating innovations in payments. Here, the cNGN, an eNaira-pegged token currently under development, comes to mind. cNGN aims to bridge the gap between major cryptocurrencies and CBDCs across Africa, offering to make it easy for users to seamlessly convert their CBDCs to other cryptocurrencies and vice versa. To ensure regulatory compliance, the cNGN project is supported by CBN and a consortium of trusted financial institutions within the existing CBN regulatory framework. It is spearheaded by Convexity, a Nigerian blockchain solutions & consultancy company.

As we pointed out earlier, the CBN’s chosen approach and direction will largely shape how actors and players participate. The CBN requires adaptive, collaborative, developmental, innovative, and risk-based regulation.

Conclusion

Commendably, the CBN has been actively promoting the adoption of the eNaira by encouraging merchants to join its merchant network, hosting hackathons to help explore eNaira use cases, and even providing stipend to CBN staff through the eNaira. But the eNaira is yet far from meeting its desired goal(s). As CBN continues to drive eNaira adoption by all, certain fundamentals must be addressed. This is more so because eNaira is the same as the Naira after all, only with “more possibilities” in its digital form.

Ultimately, the CBN’s ability to gain trust and confidence of MMOs, IMTOs, international payment processors and digital payment platforms, and actors in Nigeria’s emerging blockchain industry will be crucial to the success of the eNaira. Think Chams Mobile, eTransact, Mkudi, Opay, Pagatech, Palmpay, Pocket (formerly Abeg), and other MMOs, as well as Airtel Smartcash, MTN MoMo, and other mobile platforms that provide financial services but presently licensed as Super-Agent Authorization by the CBN. Think Amazon Pay, AliPay, Flutterwave, Google Pay, MPesa, PayPal, Stripe, WorldPay, and other international payment processors, and digital payment platforms such as Mastercard and Visa as eNaira partners. Think Interswitch, MoneyGram, Ria, Remitly, Swift, Western Union, WorldRemit, and other IMTOs plugging the eNaira. Think Bantu Blockchain, Binance, Block, Circle, Coinbase, Luno, and other blockchain companies adding eNaira as a payment option on their platforms. Also, other local actors and Nigerian diasporans and other key stakeholders cannot be left behind.

Essentially, the CBN must engage more—and better too—as the financial service industry’s most reliable, transparent, and trusted partner. This is vital. And this is more so because the irony about eNaira adoption or CBDC adoption generally—or any innovation for that matter—is that what amounts to pros and cons often depends on perspectives. The likely disintermediation of banks by the adoption of the eNaira as a CBDC is for instance a major concern that does not appear to have been adequately addressed by the CBN. This is where thorough consultations, research, and stakeholder engagements come in.

Similarly, any lack of trust and confidence in Nigeria’s monetary system, eNaira’s technology, or even the CBN as the institution behind the eNaira has to be effectively addressed.18 Clearly, the CBN will not gain the level of trust and confidence it needs to make the eNaira leap from the cage if it doesn’t improve and enhance regulatory accountability, operative transparency, and supervisory integrity in the Nigerian banking and financial system. There will be a need for more roundtables. There will be a need for more research-backed thought leadership, open multi-stakeholder engagements, and feedback systems than circulars, directives, and sanctions. This will ensure that any distrust, fear, and lack of confidence—with the opacity and poor participation often associated with this—can be gradually replaced by assurance and confidence amongst actors. It will also encourage inclusiveness at the triangular angles of innovation, policy, and regulation. In such an environment, the ultimate beneficiary will be the consumer, the investor, and the general members of the public. It will reassure all stakeholders, local and global, that Africa’s first CBDC truly means business.