Background Law Practice as a Business, a new book on the business of making money in legal practice, has been released by Stephen Azubuike, Partner at Infusion Lawyers. Stephen has a natural inclination to share information with others. Combined with.. Read more

‘Law Practice as a Business’, a New Book by Stephen Azubuike, Partner at Infusion Lawyers

Regulatory Update: Nigeria Data Protection Bureau (NDPB) extends deadline for Data Compliance Audit Returns to 30 June 2023.

The deadline for filing the Data Compliance Audit Returns for the year ended 2022 in Nigeria has been extended to 30 June 2023 by the Nigeria Data Protection Bureau (the “NDPB”). This means Data Controllers and Data Processors who have not filed their returns before the regular and statutory deadline of 15 March of every year now have ample time to do so.

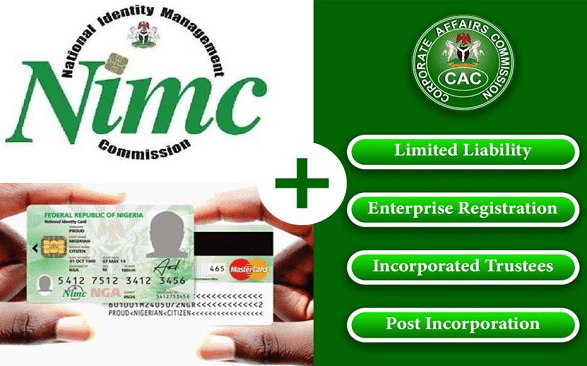

Regulatory Update: Mandatory use of National Identification Number (NIN) for applications to the CAC in Nigeria

From 1 March 2023, the National Identification Number (NIN) shall be the only acceptable mode of identification for all processes to be filed at the Corporate Affairs Commission (“CAC” or “the Commission”). Consequently, applicants shall be required to enter their NIN in the appropriate fields on the appropriate online-application form provided via the CAC portal.

Digital Money Lending and Loan Sharks: Complying with the new registration requirements in Nigeria

In this piece, I discuss the investigations of digital money lenders or loan apps and the regulatory measures taken by relevant regulators to curb loan sharks. For both existing and intending digital money lenders, requirements of the FCCPC Framework and deadline for obtaining FCCPC’s approval are also discussed. In addition to other applicable regulatory requirements for digital money lenders in Nigeria, digital money lenders are strongly encouraged to comply—and timeously too—with the registration regime introduced by the FCCPC.